B2B Or B2C - Who Are You Really Selling To?

As a B2B Marketer, you're still marketing to individuals. Here are the three layers of communication you need to appeal, equip, and mitigate.

B2B SaaS companies often face the unique challenge of carving out their own space in the market. When your solution is truly innovative, it can be difficult to connect with the right audience, especially when they don't fit neatly into established categories.

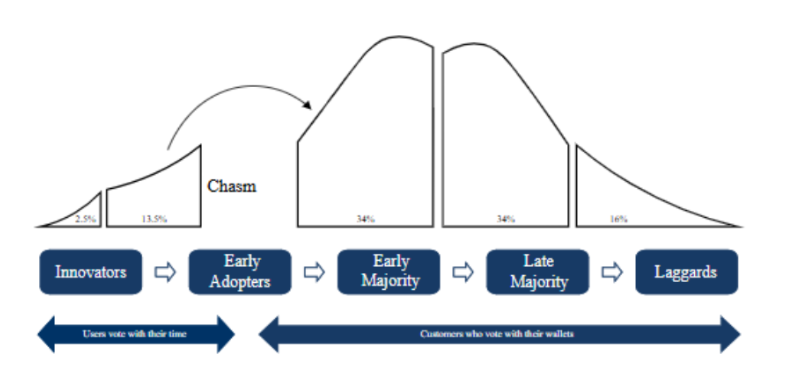

This is where understanding your market's maturity level becomes invaluable. Geoffery Moore's technology adoption curve provides a helpful framework for identifying where your ideal customers fall within the spectrum of innovation adoption – from the eager innovators to the more cautious late majority.

By aligning your go-to-market strategy with this understanding, you can focus your efforts on the segments most likely to embrace your solution.

Why do we segment? Segmentation is a strategic approach focused on targeting the most viable portions of the market.

It begins with an understanding of your total potential market using the TAM, SAM, and SOM framework.

Understanding these market sizes helps in refining your approach from a broad audience to a focused, actionable target.

With a clearer understanding of TAM, SAM, and SOM, let's explore how to effectively segment within your serviceable markets.

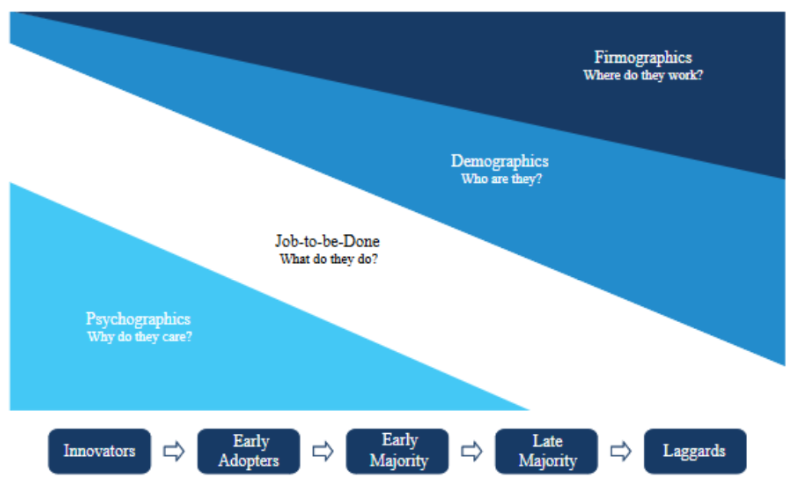

There are many ways to segment your market and the most common one is firmographic segmentation. This method involves segmenting the market based on various attributes or properties of organizational entities or companies, such as:

Because these are attributes that you can identify at an organizational level, this approach is referred to as firmographic segmentation.

This one is all about the people in your audience. You are looking at aspects like their job title, function, background, and sometimes age—though in B2B, it’s more about what ties to their work. Think about roles and responsibilities over personal details.

Harvard calls this "job-to-be-done." It’s about what problems your audience is trying to solve—kind of like use-case segmentation. What’s the task or goal they need help with? Focus on that, and you’ll get to the heart of their needs.

This is where you go deeper into behaviors and intentions—what people want, their values, or even what grabs their attention online. Maybe it’s memberships, hobbies, or what they click on most. It’s about figuring out what drives them.

In this approach, we align the four segmentation models with the maturity of the market you’re operating in. Market maturity can be categorized into several stages along what is commonly referred to as the "Technology Adoption" curve:

Understanding market maturity is essential, particularly for small, new software companies, as the segmentation method you choose often correlates directly with the phase your market is in.

Firmographic segmentation, or targeting specific industries, is usually more appropriate when your market is further along the maturity curve. In the laggard or late-majority stage, certain industries often require specific technologies or solutions. This can be driven by regulatory requirements or because the solution has become a mandatory standard within the industry.

If your market hasn’t reached that level yet, it might still be developed enough to identify individuals with specific job titles who need your solution. For example, if you’re offering expense management software, sales performance tools, or monitoring solutions, there are likely roles with titles that suggest they could be potential buyers or show interest in what you’re offering.

Demographic segmentation works well when your market isn’t mature enough for firmographic segmentation, where industries can be clearly mapped to your solution. If the market is still in the early majority or early adopters stage, it’s often more effective to focus on use cases—identifying who is trying to solve a specific problem your solution addresses.

In less mature markets, it’s less about titles and industries and more about finding people with a particular job to be done. These individuals might hold various roles across different industries but share the same need your product fulfills.

Psychographic segmentation becomes most valuable when your market is in its earliest stages, and you’re looking for innovators. These are people who won’t necessarily buy your product right away but are willing to invest their time in helping you refine it. You can identify them through content that gauges their reactions—such as interest in beta programs or other signals that they’re early adopters or innovators. This is where psychographic profiling can truly make a difference.

Market segmentation is about truly understanding your customers and their needs. It's a powerful tool that helps B2B SaaS companies like yours connect with the right people at the right time.

In a mature market, you might focus on specific industries that are ripe for disruption. In a newer market, it might be about identifying key decision-makers who are eager to embrace innovation. And in those very early stages, connecting with passionate early adopters can be invaluable in shaping your product's future.

The best part? Your approach can evolve as the market does. By staying flexible and continuing to learn about your customers, you can build lasting relationships that drive sustainable growth.

At Kalungi, we use our deep understanding of market segmentation to help B2B SaaS companies develop targeted go-to-market strategies with our proven T2D3 framework.

Ready to take your B2B SaaS business to the next level? Let’s talk

Stijn is Kalungi's co-founder and board member. He is a serial SaaS marketing executive and has over 30 years of experience working in software marketing. He is co-author of the T2D3 book and masterclass that helps startups drive exponential growth.

As a B2B Marketer, you're still marketing to individuals. Here are the three layers of communication you need to appeal, equip, and mitigate.

Wondering If your B2B SaaS Marketing function needs a Partnerships Strategy? Get a first look into Channel Marketing strategy and a free Go-to-market...

When you hire your first Marketing Intern or Junior Employee, here is a list of tools and training to help them get started with B2B SaaS Marketing.

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.