How To Make A Cold Call Or Email A Bit Warmer

When sending cold emails out, make sure they are extremely relevant, to the point, well written and have the right landing page with valuable follow...

Leading a small company to become big is all about focus. This article helps you find and verify the niche that you choose to nail and lock the plan to go climb the hill.

You'll get a formula to create your SAM from your TAM, and your SOM from your SAM. Are those acronyms new for you? Read on.

You have to secure a beachhead so you can bring in the growth capital supplies, and mount your assault on exponential growth.

The formula explained here allows you to go from TAM (Total Addressable Market) to SAM (Specific Addressable Market) using a methodological approach, including your existing market penetration and product-market-fit proof points.

|

|

|

As the next step, you can go from SAM to SOM (Specific Obtainable Market) by being realistic about your abilities, and the cost and complexity of execution. The approach will take into account factors like the time needed to execute and required resource investments.

Your TAM (sometimes also an abbreviation for Total Available Market) is determined by the market that you want to play in. This includes every type of customer that you would like to reach if you have unlimited resources (and time). The size of the market in $ is the total market demand for the product/services category and the potential scale of the category.

If the market you have picked is established, it often has solid analyst coverage, and potentially a Gartner Magic Quadrant, Forester Wave or equivalent “name” for the category.

Examples of established categories that could be your TAM definition:

Here is a list of all 98 Magic Quadrants, and Forrester Wave reports.

Most small companies will focus on a subset of the established markets described above. Some though, will try to “make a new market.” If you plan to create a new category or have a hard time defining your market, the below approach might be less suitable for you.

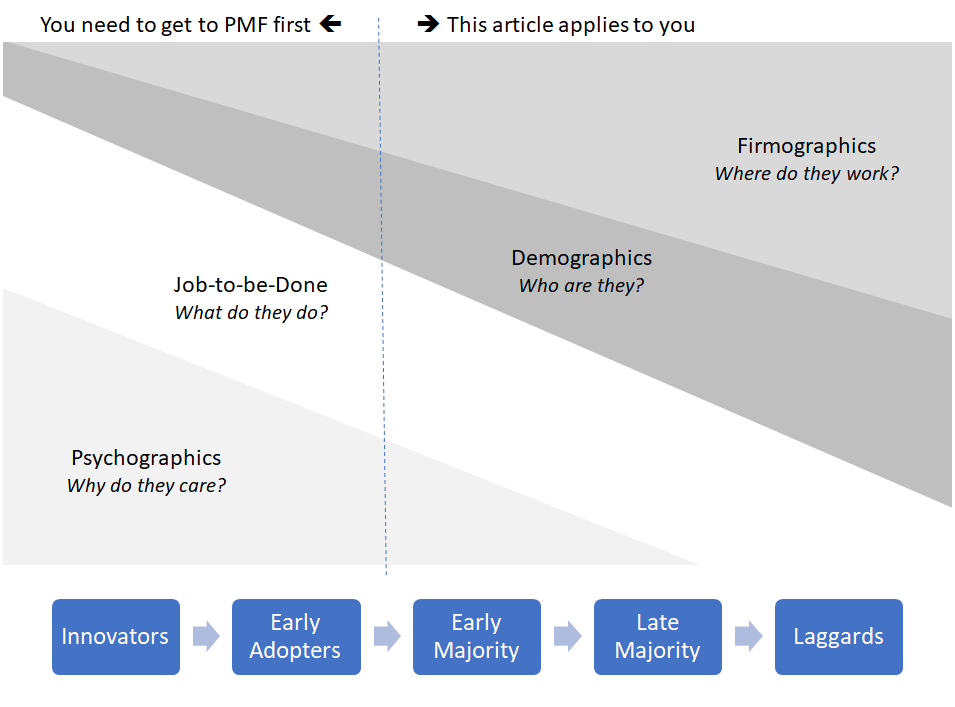

The below picture is a simplified view of what type of Market Segmentation is most effective given the state of maturity of the Product/Service Category you want to succeed in (your TAM).

Check out this article that is the source of the above model, and that addresses “crossing the chasm” for companies that are market makers in more detail.

Smaller, or less mature markets, can be found on marketplace websites, or recommendation- and review websites. Examples are G2 Crowd and Capterra (owned by Gartner), or toptenreviews.com. If a category is ripe to have a TAM analysis, chances are you can find it on an online review or analyst site.

Here is a helpful article to help you calculate the dollar value for your TAM.

If you know what our Total Addressable Market is the first step towards focus is to select a segmentation model to divide the market into meaningful chunks.

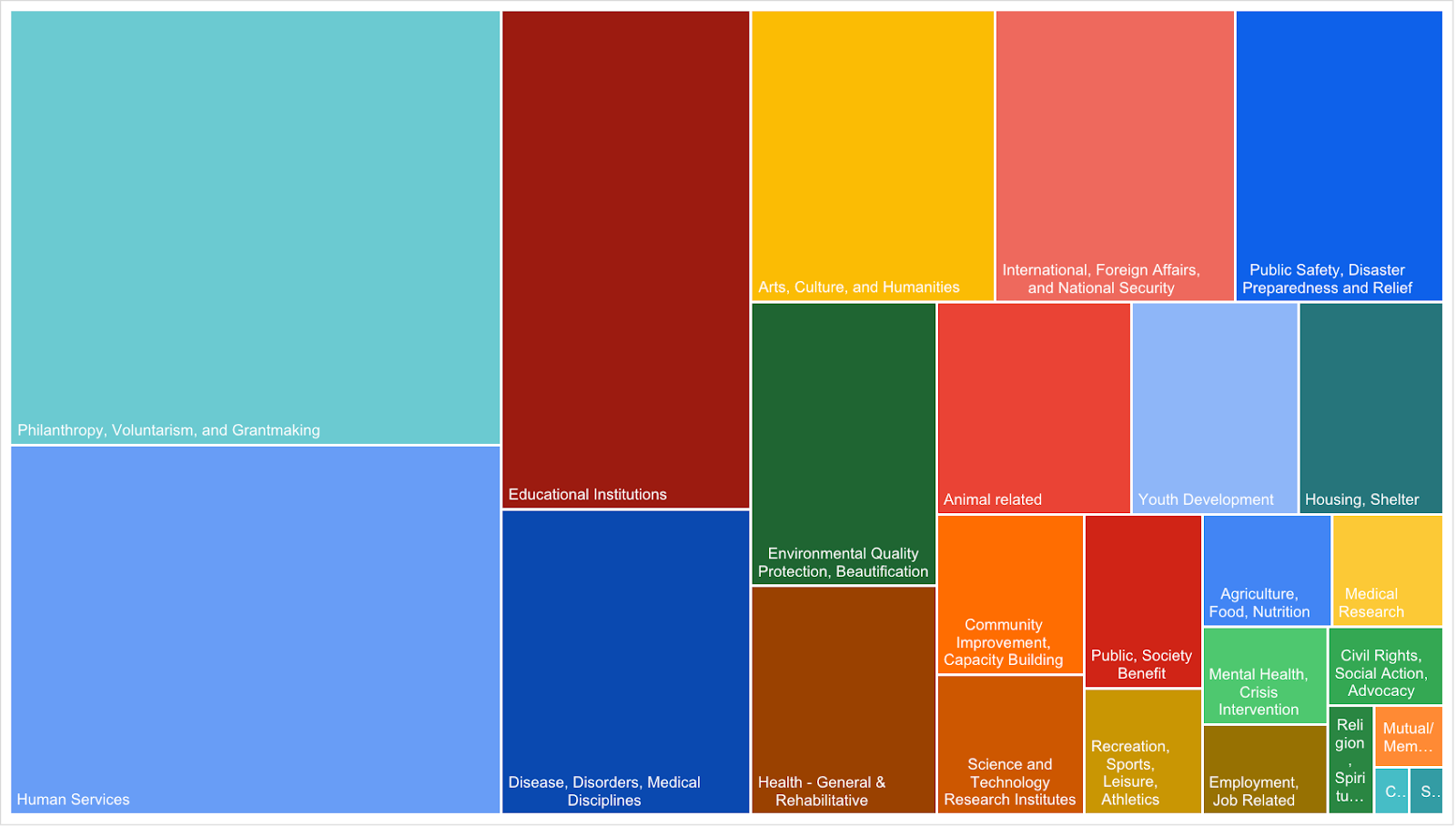

What segmentation will make sense for your business will vary. If you are a Software Company providing Subscription Payment Solutions, a simple way to segment the market could be by Industry Vertical. For a provider of services to Non-profits, the below distribution in Donations reported for Non-Profits sub-segments making up a $63B market, could be a good start.

As an example, I’ll share the analysis that our team at Kalungi has used to focus our Go-To-Market. Our business is focused on helping smaller software companies that have recently been funded, to deploy their growth capital fast and in a responsible, efficient way that maximizes quick returns.

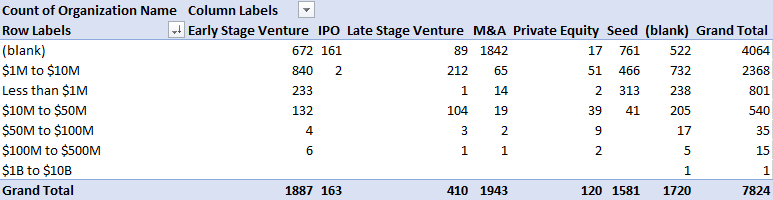

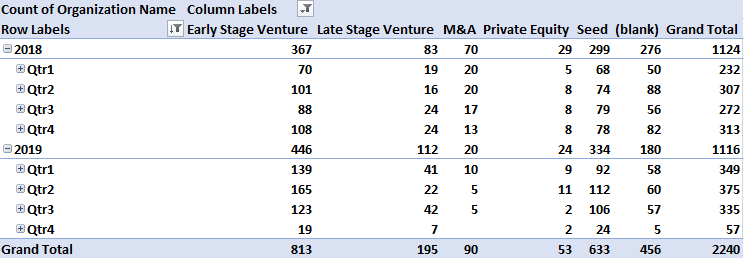

Our “TAM” can be described as all the software companies in North America that have been funded recently. Below table shows these 7824 Companies and Organizations, grouped by Revenue Band.

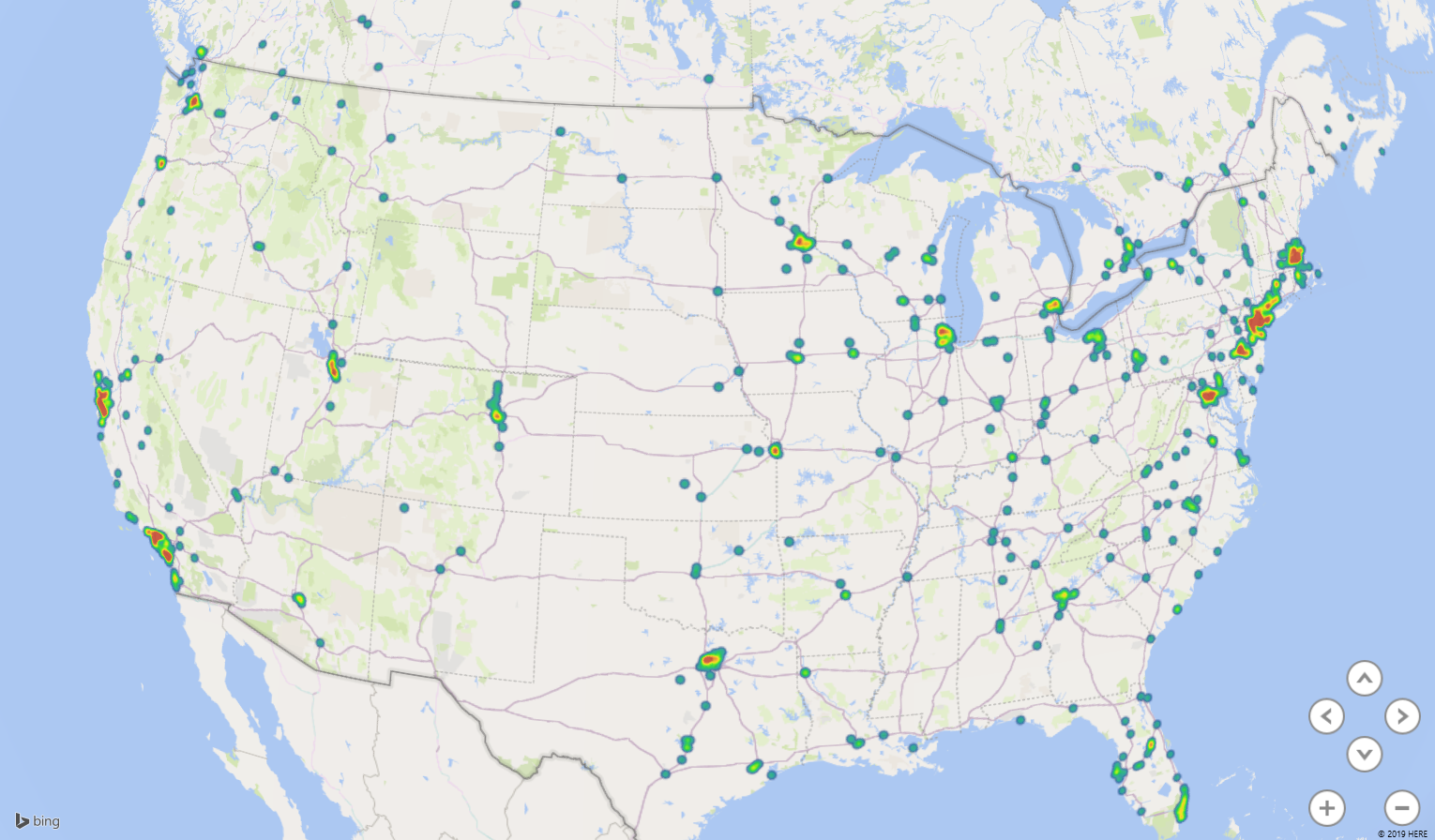

If you use Excel, a simple dataset like this can quickly be turned into some cool heat maps as well:

A mistake many business leaders make is to use the above type of analysis to focus on the big segments (or “hot spots”). This can be disastrous. Read on to understand why.

Your SAM (also called Segmented Available Market) is limited by how your Technology and Services can provide the best service for the market.

Where have you reached the so-called “Product-Market-Fit”? What does your Ideal Customer Profile look like? What parts of the market can you reach given Geographical constraints?

To find your market to focus on, you need to know what you do best.

Finding the best bridge for you to go from TAM to SAM is about finding the best way to define who fits your value proposition. To define your SAM, you have to apply the right segmentation to your TAM.

Here is an example for illustration purposes. The following segmentation dimensions are useful for Kalungi’s work servicing SaaS companies:

The data points under #2 need to be added to our list. The team at Kalungi can enrich a list to do so and make your SAM more precise. In this example, I’ve just applied the firmographic filters that are available in my public dataset (I used Crunch base).

Filter 1: Revenue Size - This filter takes the TAM from 7825 to 7023 entities.

I cannot emphasize enough that if you have not reached Product Market Fit, or are in an immature category, the above methodology using Firmo-graphics and Demo-graphics will be hard. You probably have to revert to Psycho-graphics and “Job-to-be-Done” segmentation models to get your best SAM.

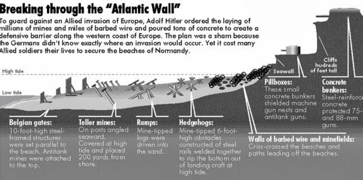

Someone I worked with used the analogy of a “Beach Head” to describe the “SAM” part of this analysis. Where do you currently win and have momentum? Just like a Beach Head on D-Day provided the Allied forces advantages like access to supply lines, and an ability to bring in reinforcements and “heavy armor”, your “Product-Market-Fit” Beachhead gives your access to segment-specific endorsements & referrals, and potentially an opportunity to dominate a part of the market and prevent having to compete on price.

What SOM, or % Share of the Market, can you realistically capture? How many customers can you reach and serve, especially given a specific time frame? How hard will it be to compete in specific parts of the market? Are certain trends or policy changes going to help or hurt you? Where is your sales team located? What channels do you have? What channels can you build and how fast?

Determining your SOM is all about picking a 'Niche' based on what only you can do, and where to go first, and "Nail that Niche." Consider the following factors:

To build on the Normandy Landing analogy, this is about finding the easy path to victory. Some beaches like "Gold" were easier to land on then, for example, "Omaha".

|

|

To test your SAM and turn it into your SOM, you can start with listing your "dream clients" and your current customers, and divide them as follows:

Verify the last category by creating a database of your existing customers, including the segment data you have used for your TAM calculation. Look for meaningful outcomes that indicate success in your business (recurring revenue per customer, number of users, etc.). Use this to come up with what you think of as your "Ideal Customer Profile" or ICP.

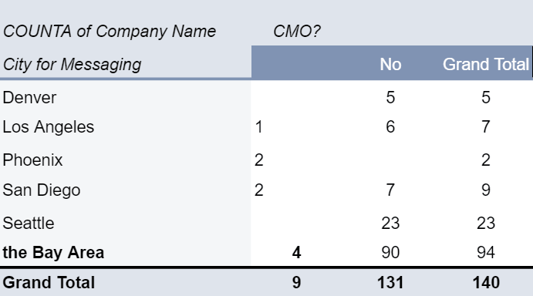

To finish the example, here's how Kalungi determined it's SOM from the SAM.

This is where we landed with the SOM for 2020 for Kalungi:

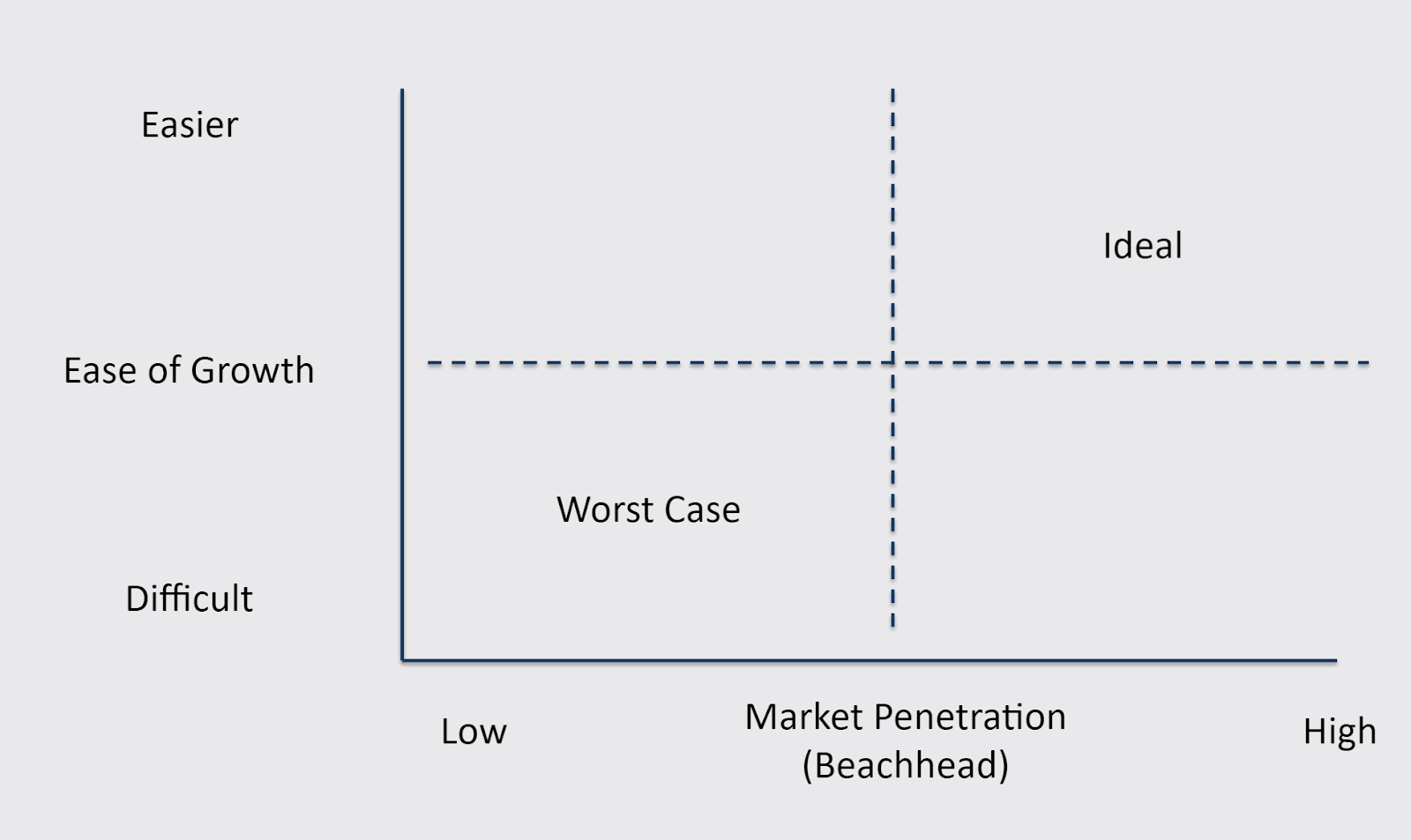

To summarize how we go from TAM to SAM to SOM, or better, how we prioritize the Go-To-Market, we used the following two dimensions.

Where do we have Beachheads that we can exploit and show credibility to new prospects?

To find what customers are going to be easy to drive growth, we look at the following signals:

With the two above “Axis,” we can rank the different verticals in order. It’s all about relative position. In a bubble chart, we can create bubbles the size of the ARR TAM for each Vertical/sub-vertical/use cases.

Finally, success in the crowded B2B Software space usually follows one of three strategies. Fight (beat the competition) or Fly (disrupt and redefine the market), or Focus. This article was about applying the focus to your strategy. Good luck nailing your Niche!

Stijn is Kalungi's co-founder and board member. He is a serial SaaS marketing executive and has over 30 years of experience working in software marketing. He is co-author of the T2D3 book and masterclass that helps startups drive exponential growth.

When sending cold emails out, make sure they are extremely relevant, to the point, well written and have the right landing page with valuable follow...

How to monitor SEO progress and measure performance. Align Content and SEO and consistently monitor progress against leading indicators to ensure...

Finding a place for your product in the market is hard. Product marketing, a proper feature matrix, and a smart pricing strategy can help you stand...

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.