Great Brand Value Examples

Company values are critical to building a sustainable brand. Brand values need to be clear, constantly repeated and communicated and updated as...

At a high level, a SaaS business valuation is how investors and owners determine the economic value of a company.

But when it's time to exit or find investors, how do you effectively quantify a company's risk and reward, opportunity cost, and every other value-determining quality while ensuring you're not leaving any money on the table?

Determining a company’s value is complicated. Each valuation is impacted by industry, type of business model, value proposition, and much more.

Additionally, there’s not one singular way to determine a company’s value -- rather, various methods must be used to measure the company’s final value.

By understanding SaaS valuation drivers and attributes, you can make sure that you’re not making a bad deal or underestimating your company's worth.

In this guide, we'll be covering:

Let's dig in.

If you need examples to generate ideas for your workshop members, share this list of growth lever examples with them.

When it comes to valuing B2B SaaS companies, investors and owners consider different company attributes and qualities than for non-SaaS businesses.

In 2021, the median SaaS valuation multiple for public companies dropped from its 2020 spike, a record high of 16.9x ARR, down to 10.7x ARR by February 2022, while that for private B2B SaaS companies, who did not experience the same jump, stayed more constant, hovering between 5x to 8x ARR as they have in recent years:

B2B SaaS companies vary from the traditional business in a few ways:

Additionally, because software companies don’t have finite supplies as manufacturers or retailers, B2B SaaS companies don’t experience supply chain limitations like forecasting shortages, limited production quantities or lack of supplier diversity.

There are three main ways to value a software-as-a-service company by examining the company’s earnings: SDE, EBITDA, and Revenue.

Depending on your SaaS business’s profitability and maturity, you might pick one valuation method over another to give yourself a better multiplier.

The first method of valuing a software business is through Annual Recurring Revenue (ARR). ARR buyers are willing to pay multiples of ARR as they see the value of recurring revenue, and more and more private equity firms are migrating toward this category of valuations.

While some consider this the last option of valuation, we think that a revenue-based valuation is optimal if your SaaS company has just achieved product-market fit (PMF), you’re driving T2D3 growth, or you’ve earned $1 to $100 million ARR.

Pro Tip: At Kalungi, we call these two stages of SaaS growth ‘Start’ and ‘Scale.’ Because SaaS business models use a subscription model to generate revenue, they can find PMF and generate ARR or MRR quicker.

To achieve a valuation based on a revenue multiple, you need an ARR greater than $2 million and YOY growth rates over 50%.

If your SaaS company is experiencing (or plans to experience) hyper-growth, opt for a revenue-based valuation over an EBITDA-based valuation because your revenue will grow, but you won't be super profitable.

Seller Discretionary Earnings (SDE) is the remaining value after the owner has paid all expenses (including payroll, overhead, and tools) and added their salary back into the business to display its earning power.

Here’s how you calculate SaaS SDE:

For businesses with a sole owner or under $5 million in ARR, valuation through SDE makes the most sense.

Suppose your software company has reached the rule of 40, or you have a generally low customer acquisition cost (CAC). For SaaS buyers looking at an EBITDA Valuation, they're deriving value from the company's ability to deliver a strong cash flow. This may be driven by the need for a Private Equity firm to borrow cash flow.

Additionally, the EBITDA model is about profit so SaaS companies under the $5 million revenue mark can still realize a high multiplier. In this case, an EBITDA-based valuation may give your SaaS valuation the highest possible multiplier.

EBITDA stands for Earnings before interest, taxes, depreciation, and amortization and proves beneficial for companies with high profits.

To calculate your SaaS company's EBITDA, use the following equation:

This method takes into consideration different factors for more mature, developed businesses. Thus, EBITDA valuation is often used for a company with earning power above $5 million ARR.

Now that we've covered the basic valuation models, let's explore the question you're actually here for identifying your SaaS valuation multiplier.

21st-century companies are typically valued by multiple to reflect the true, long-term value of a business. The more established the business is (or the more a business depends on larger and longer-term contracts) the bigger the multiplier.

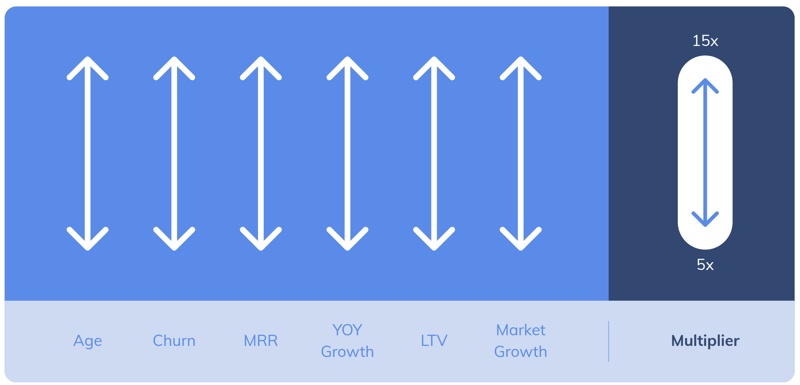

B2B software companies can be valued from anywhere between 3x and 15x their annual revenue -- determined by a mixture of parameters, who is conducting the valuation, and other valuations within the industry at the same time.

In a business valuation for software companies, the listing price is:

As a general rule of thumb, the B2B SaaS valuation spectrum looks something like this:

But what determines this valuation multiple? Let's break down the critical factors that affect the SaaS company valuation:

Some influential factors in your SaaS valuation may be out of your control, but others are definitely within your reach. Here's what you need to focus on:

Let’s break these down further.

You want strong, reliable revenue with strong cash flow, and are typically categorized into the following segments:

Note that there are two types of revenue in a SaaS valuation. Non-Recurring, like professional services, onboarding/setup fees, or migration charges, and Recurring Revenue, usually described as either monthly recurring revenue (MRR) or annual recurring revenue (ARR).

Investors typically like to see MRR over ARR because monthly revenue is more reliable. To make your software company’s valuation increase when you’re ready to exit, focus on increasing MRR over ARR. We'll cover how to increase ARR and MRR in a few moments, in addition to other ways you can enhance SaaS KPIs directly related to your SaaS valuation multiple.

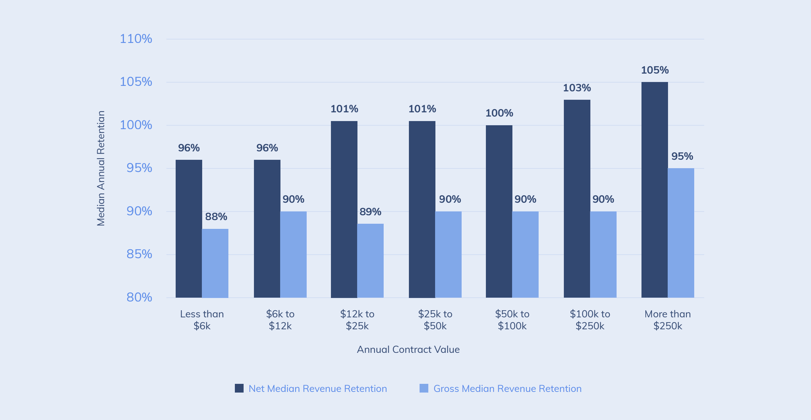

SaaS NRR is the percentage of recurring revenue retained from existing customers within a defined period of time. This includes subscription expansion revenue, subscription downgrades, and subscription cancellations.

Another way to represent customer churn, SaaS NRR gives a comprehensive view of positive and negative changes within customer retention. Across all SaaS companies, the median NRR is ~100%. However, Higher ACV (annual contract value) products have a higher NRR.

For SaaS companies selling into small and medium-sized businesses, a good NRR is around 90%. For enterprise SaaS, 125% is a good NRR:

Other names for NRR include Net MRR Renewal Rate, Net Negative Churn Rate, and Net Dollar Retention Rate.

A B2B SaaS company’s churn rate, or rate of lost customers, can be broken down by month or year. We recommend matching your metrics for revenue and churn to be either monthly or annually. Still, it's important to note that 'acceptable' churn rates vary depending on your customer base and market. We break these up into three categories: SMB, MidMarket, and Enterprise.

Customer churn rates may range between 5-7% annually for a healthy valuation. This means that around 5 out of every 100 customers leave.

For a SaaS business that services SMEs, your churn rates can be a bit higher, given the number of small businesses that fail every year. However, for SaaS businesses targeting enterprise customers, you should have a churn rate of 10% or less.

On the other hand, churn can be measured by your company’s renewal rate. Because a SaaS company relies primarily on subscription-based revenue, the customer will likely turn into a renewing customer. Renewal rates over 90% are healthy and positive. However, churn is a more popular metric as it often is paired with automatic renewals (leading to a better valuation).

Other qualities of a company to consider are market position, company age, industry, and the assets that come with it. While the quantitative analysis tools were concrete enough, these are a little more subjective and hard to nail down with an equation.

Let’s cover some of that here:

A company’s gross margin is the net sales revenue minus its cost of goods sold. Simply put, it’s the savings on each dollar of sales to put toward other investments (or debt). This ideally should be 80% or more.

Where will your next growth spurt come from? We like to use a tool called the Ansoff Matrix for this. Consider how large the company can grow, how quickly, and how expensive that will be. A company with $10M in revenue could mean larger acquisitions, and a company that hits $50 Million could be ready for a possible IPO.

This measures the percentage change during the past 12 months. By evaluating a company’s financial progress over time, you can compare metrics like revenue or gross margin to check how your short-term goals lead toward long-term success.

Most SaaS buyers like to see a growth flat between 10% and 20%, and shy away from YOY growth over 40%. For companies experiencing 50% to 100% YOY growth, this may be a red flag and can scare investors away.

Look for growth opportunities both horizontally and vertically. Some SaaS have limited TAM, so look for a broad buyer universe with multiple sectors to address. $100 million TAM is small and a TAM closer to $1 billion is a positive signal to your SaaS investors.

Still, growth plans should consider products or services and profit margins, and expansion opportunities.

Suppose your market is highly competitive or anticipating a large surge of competitors in the upcoming year(s). In that case, this will impact your customer acquisition cost, SEO growth, and intellectual property rights that make your company more or less likely to drive strong returns for investors. When competitors surround your SaaS company in a red sea, it’s crucial to know your positioning and value proposition.

If you’re ready to exit your SaaS company, you need to reduce your operations and management role. Your company must have strong technical knowledge because most investors come from a non-technical background. Lack of expertise can make your entire business operation -- from content marketing to product updates -- an uphill battle against more experienced, niche competitors.

Because of this, documentation is critical to help your company’s internal and external stakeholders in times of need -- from your software developers to your potential buyers. If you haven’t begun documenting and transferring your SaaS knowledge in preparation for your exit, it’s critical to start this process now.

Businesses that are two years old are typically a preferred entry point for most investors and VCs. A company at three years or older receives more of a premium multiple. The older, the better, up to a certain point.

No one client or channel should contribute to more than 10% of total sales because this indicates a high level of risk to investors and buyers. If 50% of your revenue comes from one client or customer, this can scare away investors.

To diversify your B2B software offering, use the Ansoff Matrix to understand what growth strategies you’ve currently taken and what you can do next.

This ensures that you source materials and generate revenue from multiple products and services in a diverse spread of industries. You can enter into a new market, penetrate the market you’re currently in further, create a unique solution for your current market, or pivot by offering an entirely new solution to a wholly new market. Listen to Kalungi co-founder Stijn Hendirkse discuss your diversification opportunities in this webinar.

Are you addressing a significant pain point in the industry? What’s of burning importance to your customer, and are you delighting them with a compelling solution? Are you thinking differently, challenging conventional wisdom, and creating new solutions to outwit your competitors?

Your ability to communicate and capture the loyalty of your ideal customer profile (ICP) relies on a solid foundation of who you're trying to serve, and what they value. Without clearly defined positioning and messaging, your ICP will struggle to understand what you're here for and why they should care.

On the flip side, SaaS companies with well-defined messaging and positioning, validated by your ICP and PMF, will have a much easier time communicating with and growing a customer base of loyal, engaged advocates.

How you attract customers will play an essential role in determining the multiple. For SaaS companies, B2B inbound and outbound marketing strategies like:

By having two to three of the above marketing functions in place, your potential SaaS buyers will have opportunities to expand customer acquisition channels while maintaining and optimizing existing channels. If you have these marketing channels in place, make sure you provide documentation and guidance for future hires and your marketing function.

What tech and data assets are proprietary, and does your company have an experienced management team with strong employees? From the experience and size of staff to the number of software subscriptions, these often overlooked qualities can add (or deduct) significant value from a company.

While it may not seem important, other SaaS market valuations at the same time as yours can heavily influence your company’s valuation. If public SaaS companies are being traded for $15MM, don’t trade yours for $3MM.

Now you know how to value your software company’s market price in 2024. How can you increase your software company’s value further so that your exit is everything you worked for?

Here are five ways to increase your SaaS company’s worth when it comes time to exit or find investors.

Trademarks, patents, and copyrights are essential to any business. But for SaaS companies making their way upmarket, securing your intellectual property is essential to your business development.

Owning the rights to your intellectual property can give you an enormous leg up over your competitors, and it’s never too late to take this step. If a competitor patents something you use in your business model, that can cripple your operations.

Begin by trademarking and patenting your code, product, and any other substantial assets that create a competitive advantage. Additionally, have your freelance and in-house developers sign an intellectual property assignment to limit their ability to move companies and transfer your company’s IP to a competitor down the road.

As inflation decreases the value of your money every year, you should be taking steps to counteract this through an annual price increase of around 10%, if not more. To do this, you should communicate with your customers that you’re increasing your prices and how you’re adding new value to their experience. From sharing webinars on getting the most out of your latest feature release or expanding your customer support hours, it’s essential to back your pricing increases with the value you’re adding.

Ensure that six to 12 months before you’re preparing to sell your SaaS company, you (or your sales department) don’t offer any discounts to inflate your valuation. Investors and buyers prefer to see a healthy MRR over ARR because of its unpredictable nature.

To learn more about B2B SaaS pricing optimization and pricing increases, check out our guide to B2B SaaS pricing: strategy, models, and optimization or download the guide below:

Diversifying your marketing acquisition channel, along with building out new acquisition channels, will add more value to your company. But once you’ve won customers over, how do you retain them? Your marketing goes hand-in-hand with customer success, but they’re too often disjointed.

To reduce your churn rates and improve customer retention, make sure to build out your company’s full marketing funnel with the proper nurture strategies and content to add value. This means paying attention to awareness, consideration, and decision stages of your marketing funnel, but also retention and advocacy.

Reducing your churn rates makes your SaaS company more valuable in the eyes of investors. By lowering your churn, you can lower your LTV and allocate more resources to your customer acquisition channels. You can reduce churn through various methods: onboarding programs, customer service, referral programs, and product optimization.

To increase your retention rates, simply understand why your customers are unhappy with your service or software. It’s vital to conduct outreach (via email, survey, phone, or even a customer portal) and get enough customer feedback to paint a clear picture of why your churn rate is what it is.

By doing this, you can proactively take steps to prevent your other customers from churning and develop the proper onboarding and support strategies to decrease this rate in the long run.

Documentation is the foundation of an evergreen solution. If you’re highly involved within your SaaS organization’s development, QA testing, and deployment, you need to begin documenting your processes and code.

Especially as you’re beginning to consider an Exit Strategy, having company documentation in place is essential to project continuity and success in the long run.

Once you leave, your company should be able to continue production and profitability without you. It’s your responsibility to ensure that your company is set up for success, with or without your subject matter expertise, in the long run.

Whether you’re a longstanding SaaS provider or a start-up still figuring out product-market fit, planning for your valuation is an essential part of every business strategy. Remember that investors and buyers aren’t looking for their next expensive job -- they’re looking for a sustainable growth engine with a profitable future.

To set up your company for future growth and the valuation you want, read about our SaaS SEO strategy, four ways to move upmarket from SMB to enterprise, and what to consider when you enter into a new market.

Don’t forget to subscribe to our blog and stay updated on everything you need to know about B2B SaaS strategy.

Your company’s valuation is more than just a number—it’s a reflection of your growth strategy, market positioning, and ability to scale.

At Kalungi, we specialize in helping B2B SaaS companies like yours maximize value through targeted marketing strategies, efficient go-to-market plans, and data-driven execution.

📩 Ready to elevate your SaaS valuation? Contact us today for a free consultation and discover how we can help you build a marketing engine that drives sustainable growth and unlocks your full potential.

Fadi co-founded Kalungi in 2018 with Stijn Hendrikse. He has over 20 years of experience in marketing and building businesses. He is a certified HubSpot Champion User.

Company values are critical to building a sustainable brand. Brand values need to be clear, constantly repeated and communicated and updated as...

When was the last time you evaluated your product pricing model? It’s time to learn about how value-based pricing can help your SaaS company. Keep...

Be extremely clear about what you think is most valuable when you sell your company. It can’t be everything. Your potential buyer will do the same.

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.